The commercial trucking industry is growing, with more than 3.5 million people working as truck drivers in the US. With the rise in demand for commercial truck insurance, especially among new drivers, the sector is seeing a significant change in the type of insurance available and its cost. Many are seeing a higher premium in commercial truck insurance for new drivers cost amount and noticing an overall increase in insurance premiums.

What We'll Cover

- Commercial Truck Insurance

- Commercial Truck Insurance Options

- Commercial Truck Insurance Requirements

- Benefits of Commercial Truck Insurance

- Cost of Commercial Truck Insurance in 50 States

- Frequently Asked Questions

- How big is the commercial trucking insurance market?

- What is the largest commercial insurance company's share of the US market?

- Is the commercial trucking insurance industry growing?

- How does trucking insurance work?

- What is the deductible in trucking insurance?

- How much is insurance for a new truck driver in the USA?

- Why is trucking insurance so expensive, especially for new drivers?

- What are two main categories of cost you should be familiar with as a truck driver?

- Is truck insurance a fixed cost?

- What is the difference between commercial and auto insurance?

- Is truck insurance higher than cars?

- Is trucking a high-risk industry?

- Can a trucking company be self-insured?

- How can you save money on trucking insurance?

Continue reading to learn more about commercial truck insurance for new drivers:

Commercial Truck Insurance

Commercial truck insurance is a policy designed to provide truckers with various coverage options. Each type of trucking insurance coverage is written to protect your business needs and your personal assets from a catastrophic loss.

Trucking laws are specific and vary slightly from state to state, but having a well-put-together commercial truck insurance policy will meet the different insurance laws and requirements wherever you run your trucking business.

Commercial insurance coverage can cover a single vehicle or an entire fleet, providing the same coverage on all vehicles in your operation.

Commercial Truck Insurance Options

When looking for the best commercial truck insurance, there are various options in coverage to select. Some of the most commonly chosen commercial truck insurance coverage options include the following:

- Liability

- General Liability

- Cargo

- Physical Damage

- Personal Injury Protection

- Uninsured and Underinsured Motorists

- Non-trucking Liability

- Rental Reimbursement

Commercial Truck Insurance Requirements

Though each state's requirements for commercial truck insurance vary, most states require the same basic coverage options. Standard commercial truck insurance includes:

- Liability coverage

- Non-trucking liability

- Physical damage coverage

- Motortruck cargo insurance

- Motortruck general liability

- Personal injury protection

Benefits of Commercial Truck Insurance

Purchasing commercial truck insurance provides the trucking enterprise, including trucking companies with large fleets and owner-operators, with the protection needed to keep their business and personal assets safe should an unexpected event put them at financial risk. Some of the benefits of commercial truck insurance may include the following:

- Protection against loss in property damage

- Prevents business interruption

- Protection against financial loss due to theft

- Protection against worker injuries

- Protection against lawsuits

- More work because clients will ask for proof of insurance

Additionally, since commercial truck insurance is mandatory, the most significant benefit of purchasing a policy is meeting all Federal Motor Carrier Safety Administration and Department of Transportation regulations.

Cost of Commercial Truck Insurance in 50 States

The cost of insurance varies from state to state. We have compiled a list of the average state premium rates, their ranking, and both local and national rates and have listed them below.

| Rank | State | Average Local Premium | Average National Premium |

| 1 | Mississippi | $3552 | $4664 |

| 2 | Wyoming | $4927 | $7149 |

| 3 | Massachusetts | $5447 | $17017 |

| 4 | Iowa | $5615 | $8866 |

| 5 | Arizona | $6102 | $11797 |

| 6 | Nebraska | $6259 | $8664 |

| 7 | North Dakota | $6456 | $9206 |

| 8 | Montana | $6501 | $9492 |

| 9 | Kansas | $6645 | $10160 |

| 10 | South Dakota | $6689 | $9013 |

| 11 | Wisconsin | $6714 | $9231 |

| 12 | New Hampshire | $6817 | $11390 |

| 13 | Idaho | $6887 | $9008 |

| 14 | Alaska | $6915 | $9326 |

| 15 | Vermont | $6937 | $9643 |

| 16 | Ohio | $7094 | $9933 |

| 17 | Colorado | $7294 | $12110 |

| 18 | New Mexico | $7298 | $9738 |

| 19 | North Carolina | $7450 | $10630 |

| 20 | Pennsylvania | $7536 | $12470 |

| 21 | Missouri | $7646 | $11757 |

| 22 | Illinois | $7704 | $13781 |

| 23 | Indiana | $8430 | $11141 |

| 24 | Oregon | $8484 | $11272 |

| 25 | Washington | $8484 | $12706 |

| 26 | Michigan | $8910 | $13793 |

| 27 | Utah | $9121 | $11110 |

| 28 | Oklahoma | $9376 | $13383 |

| 29 | South Carolina | $9390 | $13376 |

| 30 | Maine | $9353 | $13763 |

| 31 | Tennessee | $9592 | $13773 |

| 32 | Minnesota | $9669 | $12820 |

| 33 | Virginia | $9957 | $13119 |

| 34 | Alabama | $10284 | $14216 |

| 35 | Texas | $10533 | $14497 |

| 36 | Nevada | $10681 | $16912 |

| 37 | Arkansas | $10973 | $14922 |

| 38 | Maryland | $11112 | $16056 |

| 39 | Kentucky | $11555 | $15500 |

| 40 | West Virginia | $11687 | $14638 |

| 41 | California | $11834 | $14041 |

| 42 | Florida | $12872 | $19480 |

| 43 | Rhode Island | $14046 | $17220 |

| 44 | Georgia | $15200 | $20641 |

| 45 | Connecticut | $16946 | $17004 |

| 46 | New York | $16949 | $17585 |

| 47 | Delaware | $17351 | $19671 |

| 48 | Louisiana | $19736 | $23453 |

| 49 | New Jersey | $20763 | $20255 |

*Inconclusive data was available for commercial trucking insurance in Hawaii.

What is the best insurance company for commercial trucks for new drivers?

With several insurance companies offering commercial truck insurance for new drivers, it can be overwhelming to find the best one for your needs. Here are some of the best options for new drivers:

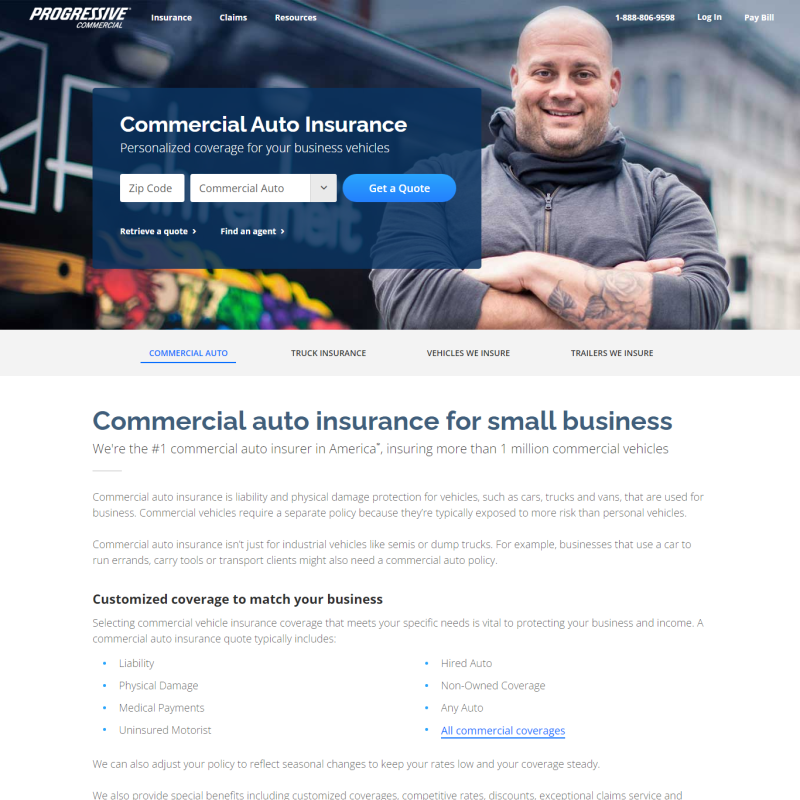

Progressive

Progressive is a great option for new truck drivers. The company offers various types of coverage, including general liability, non-trucking liability, physical damage, and truck cargo.

Progressive also offers discounts to its customers for things like using electronic logging devices and paying in full up-front. Pricing is competitive, and customers can get a quote for free through their website.

The company often accepts new drivers. However, keep in mind that new drivers may not have access to some of their discounts.

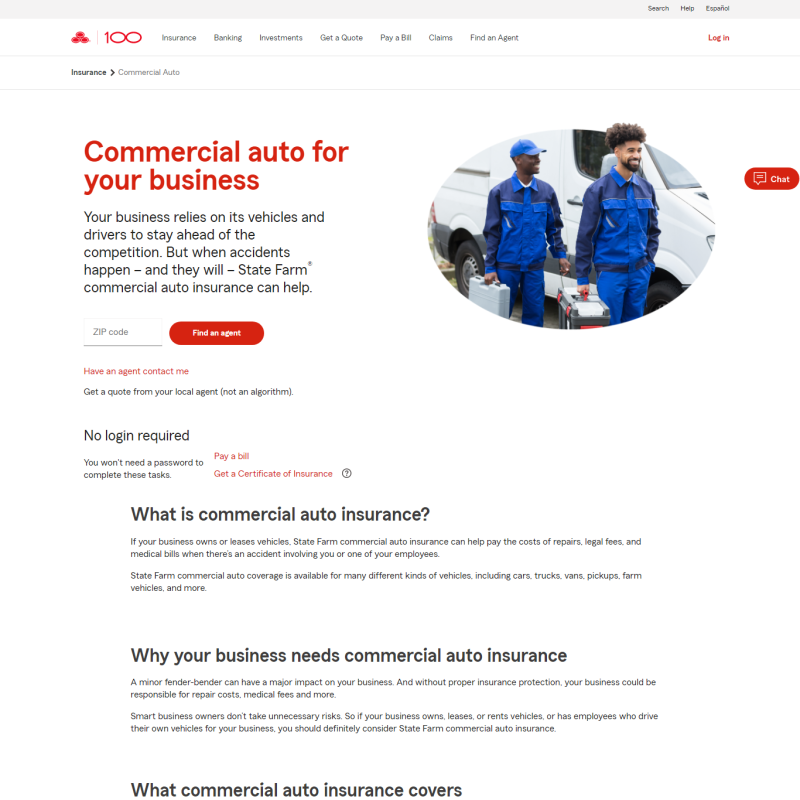

State Farm

Coverage from State Farm includes general liability, collision, and physical damage.

New drivers often choose State Farm because of its competitive rates and discount opportunities. It’s also the largest vehicle insurer in the country and is known for having good customer service.

State Farm doesn’t offer cargo insurance or online quotes. You have to go through a local agent to get a quote.

Nationwide

Nationwide offers various coverage types, including specialty coverage for certain kinds of trucks or cargo, alongside standard general liability, physical damage, and cargo insurance.

The company has a reputation for offering great customer service, is highly ranked, and has a competitive edge due to its specialty coverage. Drivers can get a quote online, and access discounts and specialized pricing.

However, despite its name, Nationwide is not available across all states. It also has higher premiums than other truck insurers.

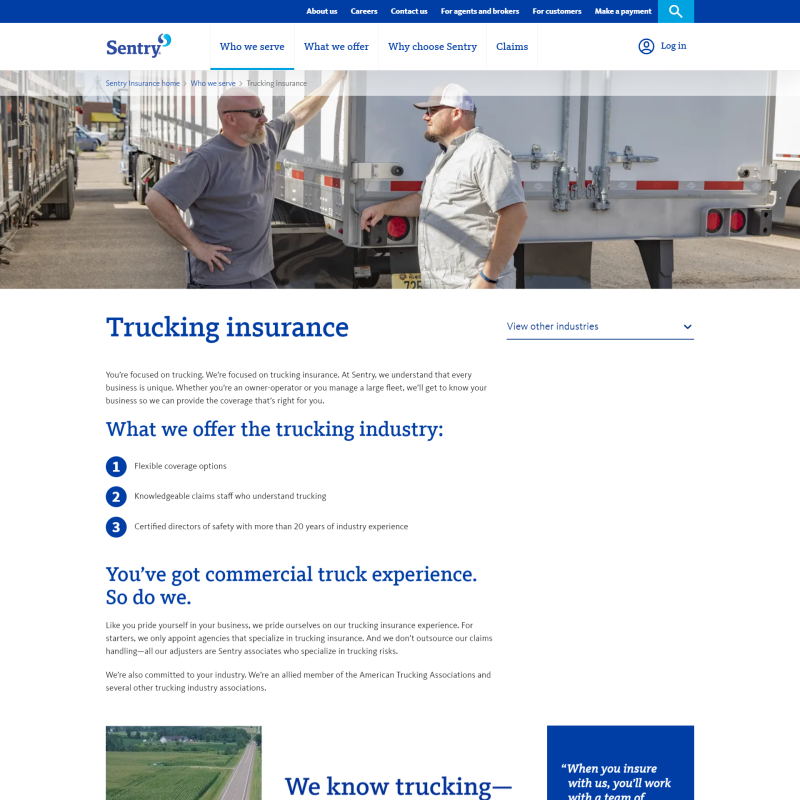

Sentry Insurance

Sentry’s commercial truck policies provide coverage for general liability, non-trucking liability, physical damage, and motor truck cargo.

The company is a great option for drivers who want a knowledgeable service team, as Sentry specializes in commercial insurance. It’s also available in all states and has tailored coverage options depending on whether you’re a new or seasoned driver.

However, you can only get a quote from Sentry through a local agent, and not online.

CoverWallet

CoverWallet is a great all-rounder, offering a wide range of types of commercial truck insurance, such as general liability, trucking liability, non-trucking liability, physical damage, and more.

Being an insurance brokerage, CoverWallet is a great option for new drivers looking for a good deal, as it shows you online quotes from different insurers all at once. Though, you may pay a small premium for buying through CoverWallet rather than directly from the insurer.

The platform also contains useful content to help you make the right decision.

However, be aware that customer service may be a little more convoluted, as queries about claims will have to go through CoverWallet to the insurer.

Frequently Asked Questions

How big is the commercial trucking insurance market?

Globally, the commercial truck insurance industry is expected to reach $248 billion by 2031. This projected amount is a significant increase from the $112 billion the industry was valued at in 2021. The expected growth is a sign that the commercial trucking insurance market is expected to rise and continue rising due to the increase in demand.

What is the largest commercial insurance company's share of the US market?

Several insurance companies offer commercial truck insurance, and according to the Insurance Information Institute, the leading insurance company is Progressive Corp. Other leading commercial truck insurance companies include Travelers Companies Inc., Liberty Mutual, Old Republic International Corp., and Berkshire Hathaway Inc.

Is the commercial trucking insurance industry growing?

Due to a growing economy and higher demand for transportation and logistics services, the trucking industry has experienced a significant increase. This increase is expected to continue in the commercial trucking insurance industry.

Below is a chart showing the projected growth of the commercial trucking industry between 2021 and 2031:

| 2021 Estimated Earnings | 2031 Projected Earnings |

| $112 billion | $248 billion |

Though demand for commercial trucking insurance is on the rise and expected to continue to increase, in some years, there has been a decrease in the total premium per mile cost. Below is a chart showing the average commercial truck insurance premiums per mile driven:

| 2011 | $0.067 |

| 2012 | $0.063 |

| 2013 | $0.064 |

| 2014 | $0.071 |

| 2015 | $0.074 |

| 2016 | $0.075 |

| 2017 | $0.084 |

| 2018 | $0.068 |

How does trucking insurance work?

Like a standard auto insurance policy, trucking insurance provides coverage needed to protect you, your business, and your assets in an accident or incident that could lead to significant financial loss. Your policy premiums go toward your insurance. Suppose you have an accident or include a business-related incident. In that case, the insurance policy will cover the financial loss, allowing you to keep your business running and continue operating as a commercial trucker.

What is the deductible in trucking insurance?

The deductible on your trucking insurance policy depends on the option you selected when purchasing the policy. For most insurance companies, the lower the deductible, the higher your premiums may be. Ultimately, the deductible depends upon your policy and insurance carrier.

How much is insurance for a new truck driver in the USA?

On average, the owner and operator of a truck can expect to pay between $9,000 and $15,000 per year for commercial truck insurance. Commercial truck insurance for new drivers costs a bit more until they have proven themselves safe drivers with good driving records.

Why is trucking insurance so expensive, especially for new drivers?

Considered a high-risk profession, the trucking industry is no stranger to high insurance premiums. Factors that cause premiums to be so expensive may include the higher risk of accidents, injuries, and roadside breakdowns. These items create a lot of liability for the owner-operator or the company, which has pushed premiums to all-new highs.

Newer truckers are seeing higher premiums because they have less experience and have not proven their safe driver abilities.

What are two main categories of cost you should be familiar with as a truck driver?

Truck drivers need to be familiar with two main categories of costs. The first is fixed costs incurred whether or not the truck leaves the parking lot. The second is variable costs incurred while driving the car.

Is truck insurance a fixed cost?

Commercial truck insurance is considered a fixed cost because the truck owner must pay the premiums regardless of whether the truck is driven.

What is the difference between commercial and auto insurance?

There is a big difference between personal auto insurance and commercial insurance. Like personal auto insurance, commercial trucking insurance not only covers damage incurred during an accident but also provides protection for the truck owner against legal expenses, business loss, and other incidents the trucking business is liable for.

Is truck insurance higher than cars?

Commercial truck insurance costs more than personal auto insurance because these policies typically have a higher limit on what is covered in the event of an accident.

Is trucking a high-risk industry?

Trucking is considered a high-risk industry, as millions of trucks crisscross the country every day. One reason trucking is a high-risk industry is that drivers are on the road day and night, some overwhelmed and tired. Another cause of risk in the industry is that drivers are hauling large, heavy items or large amounts of smaller items, which means the overall load is heavier, making it more challenging to maneuver and stop in an emergency.

Can a trucking company be self-insured?

One method to lower trucking company insurance is for the fleet owner to become self-insured. Ultimately, the trucking company is responsible for paying for the loss directly, and this money loss is a vital part of the company's risk management plan.

How can you save money on trucking insurance?

Paying for commercial trucking insurance premiums is a significant portion of your company's monthly expenses. With the high costs of commercial insurance, especially for new drivers, it is vital to find ways to cut costs and save money where possible.

When looking for the cheapest commercial truck insurance for new drivers, it is essential to consider the following ways to lower insurance costs:

- Get more experience

- Maintain a safe driving record

- Get routine maintenance on your truck

- Select routes that are less at risk

- Use a newer truck

- Install and use additional safety features and programs

- Select a higher deductible

- Find the right commercial trucking insurance agent to help

As the trucking industry continues to boom, the demand for commercial truck insurance will increase, causing many drivers to pay high premiums. Commercial truck insurance premiums are already high but can be very costly for newer, less experienced drivers. If you are a new truck driver and looking for commercial truck insurance, take the time to research the different policies available and ways to save money on your premiums.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Does Personal Car Insurance Cover Rental Cars?[Cheapest Options Listed]](/assets/images/f2074cd33086632849c2ee1dc052e3cb.png)

![Will Insurance Pay for Rental Car During Repairs?[You Must Know This]](/assets/images/2e80f9049def845cfdbfed4c6f53c013.png)

![Non-standard Insurance Companies [Full List, Pros-Cons & More]](/assets/images/32283513d0ae3563d613516a4e721396.png)