If your goal is to find cheap renters' insurance in Ohio, you might be surprised by the vast amount of options available. However, cheap doesn't always mean good, and when you're insuring your personal belongings, you only want the best.

What We'll Cover

- Best Cheap Renters Insurance in Ohio

- Monthly and Annual Rates of Renters Insurance in Ohio

- How Does Renters Insurance Differ by City in Ohio?

- How Does Renters Insurance Prices in Ohio Differ From Other States?

- What Other Factors Affect Renters Insurance Rates?

- Number of Belongings Insured

- Owning a Dog

- Residence Type

- Opting for Cash Value Versus Replacement Cost

- Final Thoughts

The best, cheapest renter's insurance agencies in Ohio are Lemonade, Erie Insurance, and USAA, for low-cost and sufficient coverage. The most affordable agencies with the best coverage include State Farm, Nationwide, and Liberty Mutual. These options cost less than $30 per month and will provide exceptional coverage to various degrees.

Although each of these options is highly affordable, some offer better coverage, rates, and deals than others, and so, the best option for you really depends on what you need from your renter's insurance. To help you determine which is best for you, we will describe and compare each agency and discuss renter's insurance rates throughout cities in Ohio and how it compares on a national level.

Best Cheap Renters Insurance in Ohio

Renters insurance isn't mandatory for any Ohio resident, but it is highly recommended for individuals living as tenants who want to protect their belongings from theft or damage.

However, most don't want to purchase this insurance at the expense of their wallet, which is why it is vital to find the cheapest renter's insurance available. Of course, you don't want to invest in a cheap policy with limited coverage, so you need to find that perfect balance.

The five renter's insurance agencies listed below are undoubtedly the best and most affordable options on the market. Some lean towards the cheaper side with more limited coverage, and others are slightly pricier but come with more extensive policy features.

Therefore, we'll discuss each agency's background, policy features, and rates to help you determine which suits your needs best.

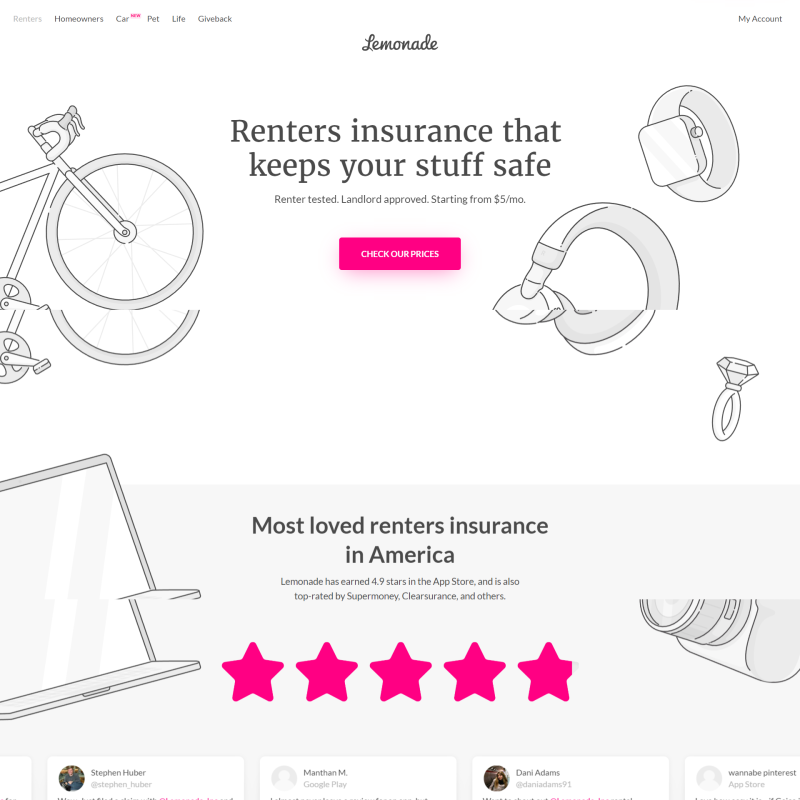

Lemonade

Compared to the other insurance options, Lemonade is the newest company established, but that doesn't make it any less of a competitor, both in reputation and price.

This company is highly innovative and specializes in offering homeowners, renters, pet insurance, and their newly added life insurance.

Policyholders can purchase their plan quickly and easily online or through the company's app and can resolve claims instantly versus the weeks' worth of waiting from competitor sites. Both platforms are extremely user-friendly and allow policy buyers to obtain a detailed quote in mere minutes.

In terms of reputation, Lemonade has a 4.9-star rating on the App Store and Google Play and is top-rated by J.D. Power, Supermoney, Clearsurance, and several other renowned companies. Their popularity has increased exponentially since their founding in 2015 and their reach, including Washington D.C., Ohio, and 26 other states.

In terms of renters insurance, the rates at Lemonade are one of the cheapest, reaching about $101 annually and starts as low as $5 per month. You can even decrease this cost more through discounts for your home safety devices.

If there's a downside to Lemonade, it's that their highly affordable policies only provide very basic coverage. Policyholders receive:

- Crime and vandalism coverage for damaged or stolen property

- Water damage coverage

- Fire and smoke protection

- Liability coverage protects against lawsuits due to accidents in your home

- Assistance on medical expenses caused by accidents or injuries while at home

If you're looking at this list and the price and think that's all you really need, then you should definitely purchase a policy from Lemonade. Realistically, this company is best-suited to college students and young adults due to its tech-savvy setup, minimal coverage needs, and highly affordable prices. We wrote a more detailed review of Lemonade's renters insurance here.

Lemonade is also a great fit for those of you who value a company that gives back. Their unique Giveback program allows them to donate substantial sums of their leftover profits to a charity of the policyholder's choice.

This demonstrates that Lemonade not only cares for their policyholders but those in the community as well.

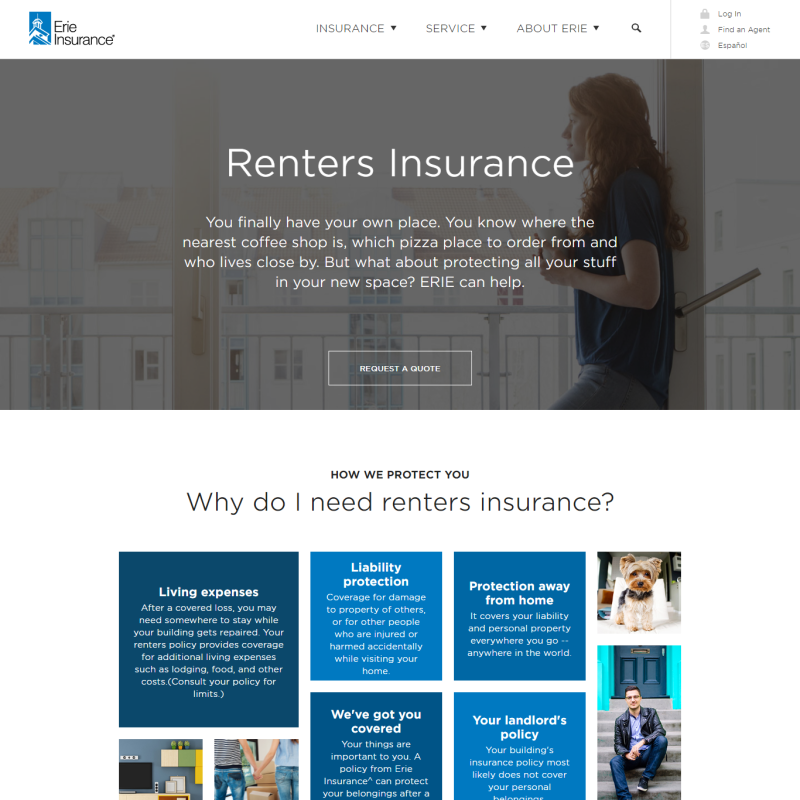

Erie Insurance Co.

Don't be fooled by its size; Erie is an exceptional and affordable insurance company despite only being available in Washington D.C. and a select number of states, including Ohio.

This company is renowned for its customer service and has a 5-star overall satisfaction rating from J.D. Power. There are also very minimal customer complaints on their site or any review websites, so this is a great choice if you highly value quality customer interaction.

In addition to friendly service, the agents at Erie are professionally trained to help guide you through your insurance purchases.

This is partly because an online quote option isn't available for customers to skip the agent and purchase their plan online. You can enter your insurance type and zip code into their websites, and it will direct you to an agent for further assistance.

This might be ideal for individuals seeking professional guidance on their purchase, but if you prefer the convenience of doing it yourself online, you won't have the option with Erie. This process also makes it difficult to determine what Erie does and doesn't cover without speaking to a representative first.

In terms of their renter's insurance, Erie provides comprehensive plans that include protection of valuables, such as jewelry or art, and replacement cost value for your belongings for competitive prices.

Besides protecting personal property, Erie also offers coverage for additional living expenses, such as lodging, food, and other costs, should you have to leave your housing due to damages or repairs.

On average, the annual cost for a renter's insurance plan through Erie is $110, depending on your city of residency, making this one of the cheapest but inclusive plan options available.

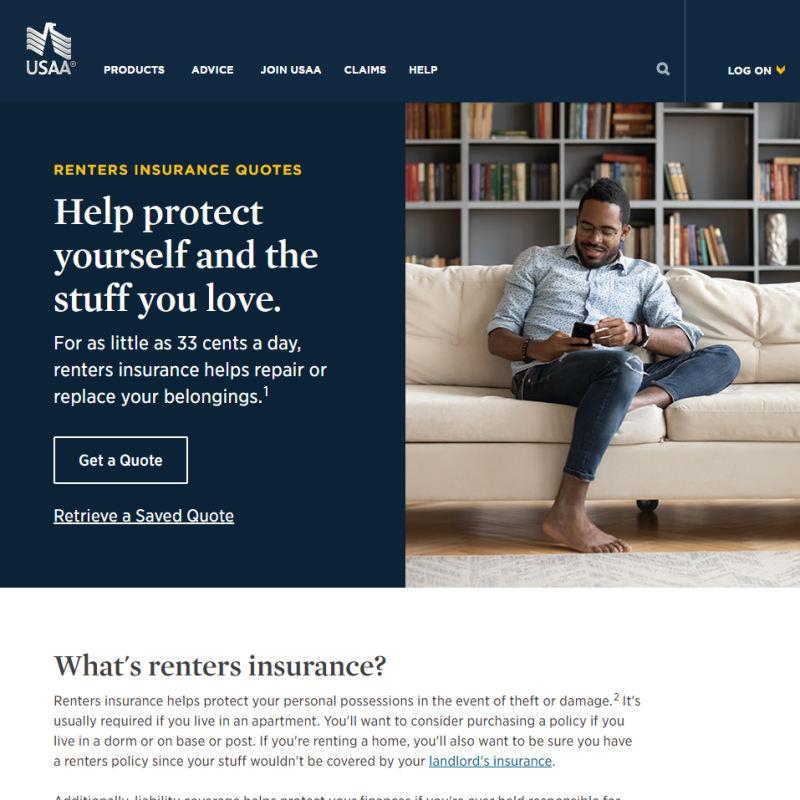

USAA

We're going to preface this insurance option by stating that it does have some strings attached, but if it applies to you, it is hands down the best renter's insurance plan you can get in all of Ohio.

The United Services Automobile Association offers a wide range of insurance plans, including renter's insurance, to active military personnel, veterans, and their families. Therefore, it is not available to all consumers, but you'll want to check them out if you fall under the applicable category.

In addition to the basic coverage of your personal belongings in the case of theft, USAA provides their policyholders protection from flood or earthquake damage, a rare feature on renters insurance. Plus, it comes with your standard policy for no extra cost, an even rarer occurrence.

Additionally, USAA offers a series of benefits you won't get with other insurance companies, including:

- Overseas insurance on your belongings after you've been deployed

- 28% off on your policy if you live on base or at port

- First-time renters' policies for your children when they move out

For those of you that want a more comprehensive visual, here is what USAA does and doesn't cover with their basic policies:

| Covered by USAA Renters Insurance Policy | Not Covered by USAA Renters Insurance Policy |

| Theft and vandalism. Smoke, fire, and lightning damage. Flood and some water damage. Building collapse and falling objects. Damage from frozen pipes. Explosions. Damage from aircraft. Riot damage. Accidental tearing, cracking, burning, or bulging. Damage from artificially generated electrical current | Some water leak damage. Building and roof damage. Vehicle damage or theft. Your roommate's stuff. Damage caused by insects or pets |

As you can see, the list of what is covered far outweighs what isn't, and all of this coverage can be yours for the low rate of $94 a year. The company promises you can expect to pay less than $10 per month and can be made even cheaper through the various discounts they offer.

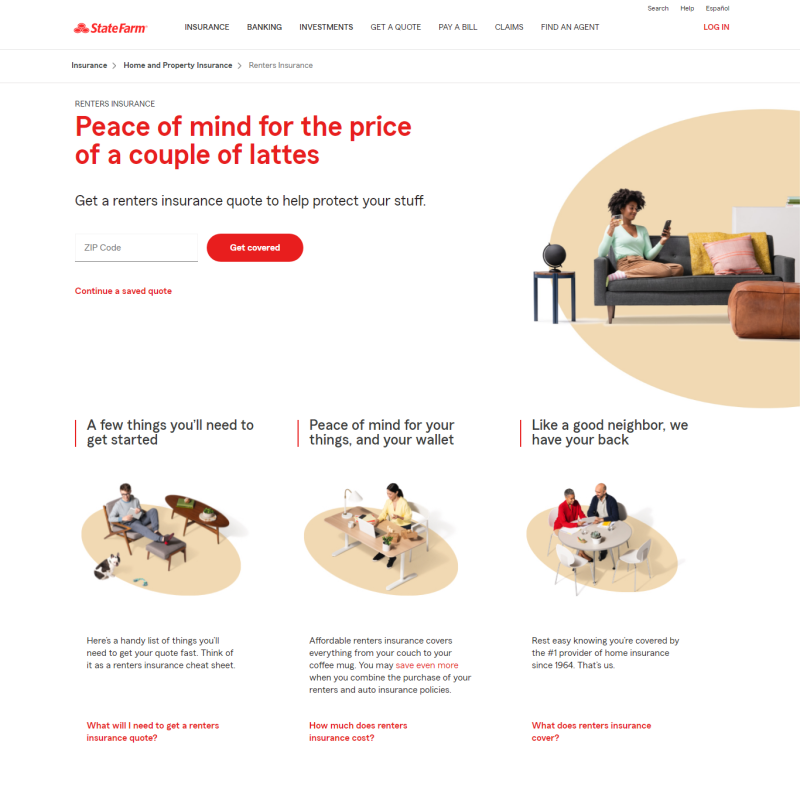

State Farm

One of the most reputable and widely used insurance agencies is State Farm, and for a good reason.

Although it might not be as cheap as some of the options previously mentioned, State Farm still has one of the cheapest renters insurance policy rates in all of Ohio.

One of the reasons policyholders opt for State farm is that their plans are far more comprehensive than cheaper competitors, like Lemonade. At about $16 per month for an annual cost of $189, State Farm's coverage is 20% cheaper than Ohio's statewide average, where many cities had an annual average cost of $200-$300.

Despite their rates being far cheaper than most companies, State Farm doesn't sacrifice service to be accessible. In fact, the features in their policies are sufficient for the majority of people searching for renter's insurance, even without the add-ons.

State Farm's basic renter's insurance policy plan covers:

- Accidents caused by vehicles, falling objects, fire, smoke, and water damage

- Weather impacts such as sleet, or ice; lightning, weight of snow, windstorms, water damage from the freezing of plumbing systems and hail.

- Malicious mischief including things like theft, vandalism, civil commotion or riots, aircraft, and vehicle damage

- Loss of use in the form of living expenses, which occurs when your home is uninhabitable from a covered loss

For those of you looking for some more extensive options, State Farms has additional coverage options for:

- Watercraft and Boats, and boating equipment

- Money, banknotes, and coins (including coin collections)

- Business property

- Securities, checks, travelers' checks, gift cards, phone cards

- Stamps, comic books, and trading cards (including collections)

- Theft losses of: firearms, jewelry, furs, silverware, goldware, rugs, tapestries, paintings and wall hangings

State Farm's only drawback is that it offers few discounts to lower policy prices. For the most part, the quote you get is what you'll be paying, but fortunately, this price is far cheaper than you could find anywhere in the state or even the country.

Your satisfaction is also guaranteed with their exceptionally friendly and helpful team that has received few customer complaints since its inception in 1922, according to data provided by the National Association of Insurance Commissioners (NAIC).

Nationwide

If you're looking for a company with renters insurance policy features and prices nearly identical to State Farm's, Nationwide is the next best option.

With an average monthly cost of $16 with an annual cost of $192 per year, Nationwide is a strong competitor on this list, particularly when you consider its high coverage limits, which aren't available in the policies of cheaper companies.

However, there are some features of Nationwide's optional, extended renters insurance policies that are already included in the standard policies of competitors, like USAA.

| Nationwide Basic Renters Insurance Coverages | Nationwide Optional Renters Insurance Coverages |

| Personal belongings, including furniture, clothing, and other items. Loss of use through reimbursing living expenses when you can't live in your rented space. Personal liability, which pays for damage or bodily injury caused by a home accident. Assistance in medical or funeral expenses for someone injured on your property. Building additions and alterations cover structural damages to your home. Credit card coverage, which covers unauthorized credit card purchases, forged checks, and counterfeit money | Valuables Plus provides additional coverage for high-value items (jewelry, watches, antiques, and fine art). Water backup provides protection against loss caused by backed-up sewers or drains. Theft extension protects personal belongings stored in or on any motor vehicle, trailer, or watercraft. Earthquake protection pays a specified amount to cover losses to your property caused by earthquakes or volcanoes |

Ultimately, State Farm provides a relatively extensive renters insurance plan that is highly affordable and suitable to most individuals, regardless of age or economic class. Their high-value optional coverage is great for families and upper-class policyholders, while its earthquake protection is a good safety measure to have in Ohio, where over 200 earthquakes have been recorded in the past two and a half centuries.

If you're torn between State Farm and Nationwide, we suggest checking the quotes for both companies in your location to see which is cheaper. Their costs will be fairly close, but the location will play a role in which is lowest.

You can also see if Nationwide has more discounts applicable to you than State Farm or for better rates. Although neither company offers as many discounts as other competitors, they are still available and can make a substantial difference to your rate.

Lastly, compare what coverage is included in their standard policy, what options you have for additional coverage, and what best suits your renter's insurance needs.

Liberty Mutual

The final suggestion we have for the best, cheapest renter's insurance company in Ohio is Liberty Mutual.

The renter's insurance policies here have an average monthly rate of $17 and an annual cost of $200 but can be offered for as low as $5 per month, depending on the common factors we've mentioned. The standard and optional policies offered by Liberty Mutual are fairly similar to Nationwide.

The standard plan covers:

- Personal property

- Personal Liability and Medical Payments to others

- Additional living expenses/loss of rent

The optional plan covers:

- Jewelry

- Replacement cost of belongings

- Earthquake damage

A unique feature of Liberty Mutual's "Additional Living Expenses/Loss of Rent" policy is that it includes tornado protection, which is another uncommon rental insurance feature. Like earthquake protection, tornado protection might be a good proactive safety measure considering 19 confirmed tornadoes occurred in Ohio in 2020 alone.

In addition to its low price and quality policy coverage, policyholders might want to opt for Liberty Mutual because it has more discounts than State Farm and Nationwide for similar coverage.

Some discount opportunities include:

- Purchasing a policy online

- Opting for a bundle policy

- Installation of protective home devices

- Applying with a claims-free insurance history

- Opting for automatic payments

Although the initial price is often a few dollars higher than State Farm and Nationwide monthly, the culmination of these discounts will render your Liberty Mutual renters' insurance far cheaper. The price will be comparable to Lemonade or Erie, but the policy will be far more comprehensive.

Monthly and Annual Rates of Renters Insurance in Ohio

For those of you who don't believe these are some of the cheapest options for renter's insurance in Ohio, let's compare their cost to the state's average.

The most expensive policy we suggested is Liberty Mutual that had a monthly average cost of $17 and an annual cost of $200. As a state, the monthly average cost of a renters' insurance policy in Ohio is $20, and the average annual cost is $237.

This puts our priciest recommendation a few dollars cheaper on monthly costs and nearly $40 cheaper on annual costs. Plus, this is before adding the various discounts Liberty Mutual has to offer. When you compare the state cost to the cheaper recommendations on your list, that profit gap grows exponentially.

Therefore, if your goal is truly to acquire one of the cheapest rental insurance policies with the best coverage, the options previously mentioned are your best places to start.

How Does Renters Insurance Differ by City in Ohio?

We've mentioned a few times already that the rates of these insurance company's policies are highly dependent on location.

As a state, Ohio has cheaper renter's insurance than the national average, which we'll discuss in further detail later, but the price can still vary significantly depending on what city you live in.

For instance, if you want the cheapest quotes and renter's insurance policy rates, you'll want to live in these areas:

- Parma

- Cuyahoga Falls

- Lakewood

- Newark

- Mansfield

- Youngstown

- East Liverpool

- East Cleveland

- Warren

- Campbell

The majority of these locations have an average cost of $18 per month, with a few peaking at $19 or $20. If you're looking to avoid the most expensive cities in Ohio for renter's insurance, you'll want to steer clear of:

- Toledo

- Indian Hill

- Euclid

- New Albany

- Pepper Pike

- Dublin

- Powell

These locations have insurance rates over $20 per month, with Toledo capping at $26. Two common factors that affect the rates in these locations are crime and natural disasters.

If you live in a city with an exceptionally high crime rate, your renter's insurance policy will be more expensive because the company more or less expects the worst because there is already a history of theft and violence in that area.

The same concept goes for natural disasters. Although this is more on a state level than a city level, if you live somewhere that is more susceptible to flooding, tornados, earthquakes, or other disasters, your insurance company with increase the price of your premiums, so you are better protected when these events likely occur.

How Does Renters Insurance Prices in Ohio Differ From Other States?

Luckily, if your goal is to have cheap renters' insurance, you're already off to a great start by living in Ohio.

The rates for renter's insurance vary widely by state and city, but the national average is $27 a month or about $326 a year, a hefty amount more than Ohio with $20 per month and $237 per year.

In terms of national ranking, Ohio usually falls around the middle to lower end of the pack in cost. The most expensive states for renter's insurance include:

- Mississippi

- Oklahoma

- Louisiana

- Alabama

- Texas

- Georgia

- Arkansas

- Tennessee

- New York

- Massachusetts

The majority of these states have average rates that range from $194 to $258, being the most in Mississippi. In terms of the least expensive states, the title typically falls to those located in the Midwest, such as:

- North Dakota

- South Dakota

- Wisconsin

- Minnesota.

These states have averages closer to $130, and a great deal of their reduced rates are due to their population size and location. However, several other factors go into your overall renter's insurance rates.

What Other Factors Affect Renters Insurance Rates?

Living in a state that offers renters insurance at a rate cheaper than the national average and pairing it with an affordable company are both great steps to saving money on these policies without sacrificing coverage or quality.

However, if you're looking for ways to make it even cheaper, here are some of the main factors contributing to renter's insurance and might help you cut out unnecessary costs.

Number of Belongings Insured

One of the first things you should do before purchasing renters' insurance is to survey your belongings and determine what you really want to be insured and how much they will cost collectively.

If you believe a $10,000 policy can cover your belongings, your rate will be exponentially cheaper than if you need $50,000+ when they are stolen or damaged.

This is also applicable to optional policies you might have purchased to insure high-cost objects like jewelry, art, or collectible currency.

Owning a Dog

Something many renters insurance policyholders might not realize is that their beloved Fido costs them far more in their insurance than if they lived with any other domestic animal.

The main reason for this is that dogs are considered "high risk," and some breeds are actually higher risk than others.

Not only are dogs far more likely to damage objects and property, but they are one of the leading causes of home insurance claims. This is due to the frequency of dog bites, which can cost your insurance company millions in medical bills and other costs.

We're not suggesting you leave your furry friend behind but be conscious that they contribute to your high renter's insurance rate.

Residence Type

When you decide it's time to move out and find a new housing situation, don't forget that the type of housing you rent affects your rates as well.

Each housing type is susceptible to its common issues that insurance companies have to consider and are reflected in your policy rates.

Some common housing situations, like apartments and duplexes, actually require their tenants to have renter's insurance if they're to move in, so being insured isn't really a choice in these situations. Plus, where you live within the complex could add dollar signs to your premium.

For instance, if you live on the top floor, you're at a higher risk because you have to deal with stairs or an elevator daily just to reach your living space. However, if you live on a lower or even the ground floor, the cost is increased on the chance that your living space experiences water damage from the rooms above.

But this is just one example. Other housing types have their own unique issues that the company will consider "high risk" and add to your cost.

Opting for Cash Value Versus Replacement Cost

When you purchase renter's insurance, the primary goal is to protect your belongings and have the coverage to replace them should they fall victim to theft or damage.

There are two ways a policyholder can insure their belongings, cash value or replacement cost. Cash value means you merely want the insurance company to pay you the amount that you purchased the item for. So, if your flat screen TV was $500, that's what you'd get if it were stolen or damaged.

The replacement cost is a little more complicated because it considers the age and condition of the item. For example, if you have a rare state from the 1930s that is only valued at 2 cents, you're not going to opt for the cash value of the item because it's worth far more than that.

If this stamp is valued at $2,000 because it is so rare and in exceptional condition, you're going to want its valued price replaced instead. Even if you purchased the stamp personally for $200, you don't want the cash value.

However, if you don't have any exceptionally valuable items worth more than their initial cost, opt for cash value on your policy. This option is far cheaper because it typically pays out less than the replacement cost.

Final Thoughts

Renters insurance is the optimal choice for individuals who want to protect their belongings without strictly owning the space they're living. Our top recommendations will ensure your belongings are safe and can even be replaced at minimal cost to you on a monthly and yearly basis.

Before you settle for a specific renters insurance company, be sure to shop around first. Since so many factors can affect your overall policy rate, get quotes from each company and compare the cost and coverage before choosing which suits your needs best. Click on the button below to shop around for multiple renter's insurance providers using BestInsurer's price comparison tool.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.