The collapse of Silicon Valley Bank sent shockwaves through the financial system. Back in March 2023 The Wall Street Journal reported that over one hundred more banks were at risk of failure. With inflation on the rise, it is more important than ever to get a good yield on your deposits. In this article, we’ll explore 3 online banking options that pay high interest on your deposits that weren’t mentioned in the WSJ report as being at risk of failure.

What We'll Cover

CIT Bank: Competitive Interest Rates for Savers

If you're in search of an online bank that provides attractive interest rates on savings and CD accounts, CIT Bank is a strong contender. Operating as a division of CIT Group, a financial holding company that offers financing and advisory services to small and medium-sized businesses, CIT Bank is FDIC-insured and focuses on delivering lower fees and higher yields due to its online-only presence.

Checking Accounts

CIT Bank's eChecking account is a digital checking account that offers interest on all balances. You can earn two different interest rates: for balances below $25,000, you'll receive a 0.10% APY, and for balances of $25,000 or more, the APY jumps to 0.25%. Compared to the national average for checking accounts, which is 0.04% according to the FDIC, these rates are quite competitive. Plus, with no monthly fees or overdraft charges, the eChecking account is an affordable choice for day-to-day banking activities.

Additionally, the eChecking account comes packed with a variety of convenient features. You'll have free access to over 91,000 ATMs nationwide, making it easy to withdraw cash whenever you need it. Their online banking and mobile app include user-friendly tools like bill pay, mobile check deposit, and Zelle for quick money transfers. The account also provides a debit card compatible with popular digital wallets like Apple Pay, Samsung Pay, and Google Pay. Plus, you can receive up to $30 per month in reimbursements for fees charged by other ATM operators, helping you save on extra costs.

Savings Accounts:

CIT Bank provides two savings account options: Savings Connect and Savings Builder. Both have no monthly maintenance fees, minimum balance, or opening deposit requirements but differ in interest rates and eligibility criteria.

- Savings Connect: CIT Bank's Savings Connect offers a 4.75% APY, and to qualify, you must open a checking account and make a qualifying direct deposit of $200 or more each month. If unmet, the account will earn a 3.00% APY.

- Savings Builder: Savings Builder offers a 4.00% APY and to earn this rate, you must maintain a $25,000 balance or make a monthly deposit of $100 or more. Otherwise, the account will earn a 3.90% APY. This account encourages saving and provides easy access to funds through online, mobile, or phone banking.

CD Accounts:

CIT Bank's CD accounts come in various terms and interest rates, with no monthly fees or opening deposit requirements. They are FDIC-insured up to $250,000 per depositor but impose early withdrawal penalties.

- Term CDs: CIT Bank offers Term CDs ranging from 6 months to 5 years, with interest rates from 3.50% to 4.75% APY. Longer terms yield higher rates but have steeper early withdrawal penalties.

- No-Penalty CDs: These CDs allow penalty-free withdrawals after seven days from account opening. CIT Bank offers an 11-month No-Penalty CD with a 4.10% APY, ideal for those seeking flexibility.

- Jumbo CDs: Jumbo CDs require a minimum deposit of $100,000 and offer higher interest rates than regular Term CDs. CIT Bank provides Jumbo CDs with terms from 2 to 5 years and interest rates from 4.25% to 4.75% APY, suitable for large investments.

CIT Bank's high-yield savings and CD accounts, with their low fees and no minimum balance requirements, cater to various savings goals and preferences. CIT Bank is well-suited for savers seeking higher interest returns without compromising convenience and security. However, it may not be ideal for those preferring physical branch locations, frequent access to funds, or a broader range of banking products and services.

Quontic Bank: Leading the Way in Cashback Rewards

Quontic Bank is another online bank that prides itself on being innovative and mission-driven. As a CDFI (Community Development Financial Institution), Quontic Bank aims to make homeownership possible for a wider range of people, especially those who are self-employed, small business owners, immigrants, people of color, and other outside-the-box borrowers. Quontic Bank also offers checking, savings, and CD accounts with attractive rates and features.

Checking Accounts

Quontic Bank's high-interest checking account boasts up to 1.10% APY on balances up to $150,000, provided specific requirements are met. These include a minimum of 10 qualifying debit card transactions of $10 or more per statement cycle, and enrollment in online banking and e-statements. Failing to meet these requirements results in a 0.01% APY on the entire balance.

The checking account has no monthly fees or minimum balance requirements and includes a free wearable payment device called Quontic Pay Ring. Customers also enjoy access to over 90,000 surcharge-free ATMs nationwide.

Saving Accounts

Quontic Bank's high-yield savings account offers up to 4.05% APY on balances up to $1 million. Among the highest rates in the market, it requires no minimum balance or monthly fees. Opening this account online takes only minutes, with a starting deposit of as little as $100. The savings account includes a free ATM card and access to the surcharge-free ATMs nationwide as well as the checking account.

CD Accounts

Quontic Bank provides CDs with terms ranging from 6 months to 5 years, featuring rates as high as 4.30% APY for the 5-year term. A minimum deposit of $500 is required to open a CD, and early withdrawal penalties apply. CDs automatically renew at maturity unless specified otherwise.

Additionally, Quontic Bank offers flexible mortgage loan solutions for borrowers who might not qualify for traditional loans, such as the self-employed, small business owners, immigrants, and people of color. As a Community Development Financial Institution (CDFI), Quontic Bank aims to serve low-income and underserved communities.

Quontic Bank is an innovative digital bank that continually evolves and pushes banking boundaries. For instance, it features a Bitcoin rewards account that pays 1.5% back in Bitcoin on every purchase and is the first digital bank in the Metaverse, a virtual reality platform where users create and explore digital worlds.

With FDIC insurance up to the maximum legal limits and robust security measures like encryption, Quontic Bank ensures the protection of your data and funds. Account access is available online or through the mobile app, which includes features like mobile check deposit, bill pay, budgeting tools, and more.

In summary, Quontic Bank is an excellent choice for those seeking high interest rates on deposit accounts without fees or minimum balance requirements. With flexible mortgage loans for unconventional borrowers and innovative products like Bitcoin rewards and Metaverse banking, Quontic Bank is not just any bank—it's a digital bank with a heart.

Axos Bank: A Digital Banking Pioneer

Axos Bank is a digital-only bank that delivers a range of offerings such as checking and savings accounts, CDs, loans, and investment options. A significant benefit of Axos Bank is its competitive interest rates on deposit accounts, which often outperform the national average and many rivals.

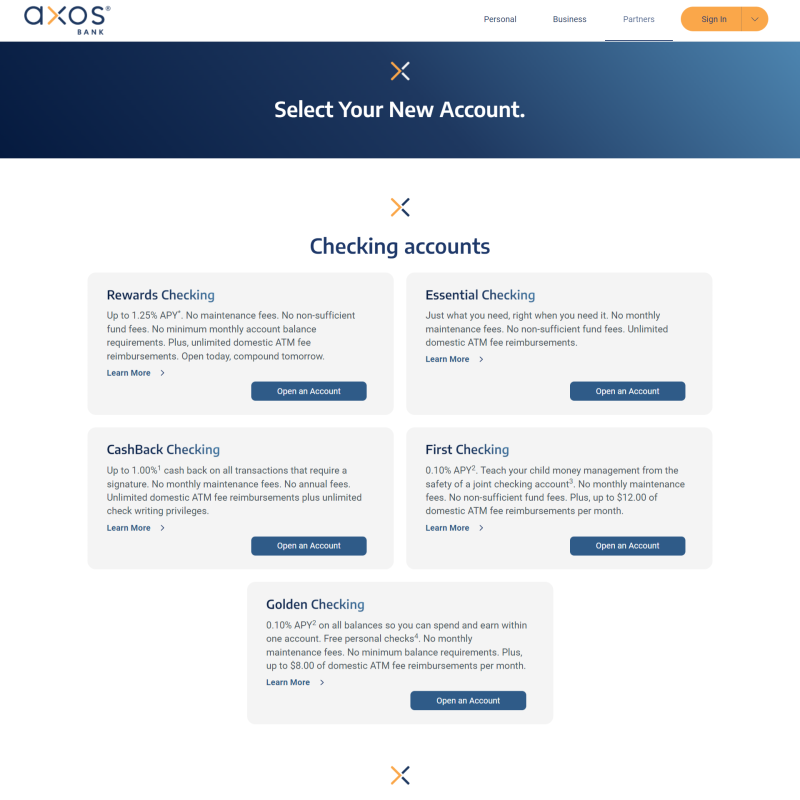

Checking Accounts

Axos Bank provides various checking account choices, each with distinct features and advantages. The Rewards Checking account is a popular option, which grants up to 1.25% APY on balances up to $150,000. To qualify for this rate, customers must fulfill three monthly criteria: receive direct deposits of $1,000 or more, use their debit card for a minimum of 10 transactions of $3 or more, and engage in five additional debit card transactions of any value. Meeting only one or two requirements results in lower rates of 0.4166% or 0.8333%, respectively.

Another alternative is the Essential Checking account, offering 0.10% APY on all balances. This account has no monthly fees or minimum balance requirements and includes unlimited domestic ATM fee reimbursements. However, it lacks a cash back or rewards program.

Savings Accounts

Several savings account options are available at Axos Bank, each with distinct features and benefits. The High Yield Savings account is a popular choice, providing 0.61% APY on all balances. This account has no monthly fees or minimum balance requirements, and customers can make up to six withdrawals per month without incurring fees.

Another option is the High Yield Money Market account, which offers 0.25% APY on all balances. This account requires a minimum opening deposit of $1,000 and a minimum daily balance of $1,000 to avoid a $10 monthly fee. It permits up to six fee-free withdrawals per month and includes a free debit card and check-writing privileges.

CD Accounts

Axos Bank offers CDs with varying terms and interest rates. All CDs require a minimum opening deposit of $1,000 and have no monthly or maintenance fees. Interest rates depend on term length and balance amount. For instance, a 12-month CD with a balance under $10,000 earns 0.20% APY, while a 12-month CD with a balance of $10,000 or more earns 0.25% APY. The highest available rate is 0.70% APY for a 5-year CD with a balance of $10,000 or more.

The primary drawback of CDs is the early withdrawal penalties if funds are accessed before the maturity date. The penalty amount varies based on term length and amount withdrawn. For example, withdrawing from a 12-month CD before maturity incurs a penalty of three months' interest on the withdrawn amount.

Investment Accounts

Axos Bank also provides investment accounts through its subsidiary Axos Invest (previously WiseBanyan). Axos Invest is a robo-advisor that crafts personalized portfolios based on an individual's goals, risk tolerance, and time horizon. Clients can select from various account types such as taxable accounts, IRAs, trusts, and 529 plans. Axos Invest charges a low annual fee of 0.24% of the account balance (or $2 per month for balances under $10,000), covering all trading costs and portfolio management services.

Axos Invest offers unique features to optimize investments and save on taxes. For example, Tax Loss Harvesting enables clients to sell securities at a loss to offset capital gains taxes. Portfolio Plus allows users to customize their portfolio by adding individual ETFs that match their preferences.

To sum up, Axos Bank is a digital-only bank that delivers competitive interest rates on deposit accounts and low fees on various products and services. It also offers investment accounts through its robo-advisor subsidiary, Axos Invest. For those seeking an online bank that can help grow their money faster and save on fees, Axos Bank may be a suitable choice.

Choosing the Right Bank: Assessing Quontic, CIT, and Axos

When comparing Axos Bank with the previously discussed banks – Quontic, CIT, and Axos – all of them provide competitive interest rates and have unique features that cater to different preferences.

Quontic Bank offers high-yield checking accounts with a cash back program, making it ideal for those who prefer to be rewarded for their spending. CIT Bank, on the other hand, provides a range of high-yield savings and CD accounts with low fees and no minimum balance requirements. This bank is perfect for savers who want to earn more interest on their deposits without sacrificing convenience and security.

Axos Bank stands out for its combination of high interest rates, low fees, and investment options, appealing to those who want an all-in-one banking solution. Furthermore, Axos Bank's robo-advisor subsidiary, Axos Invest, offers personalized portfolios and unique features that can help optimize investments and save on taxes.

Ultimately, when choosing the best bank to meet your needs, consider the interest rates, fees, and unique features of each bank. Quontic is ideal for those who prefer cashback rewards, CIT Bank is perfect for savers, and Axos Bank offers a well-rounded banking and investment experience. In the end, the best choice depends on your individual financial goals and preferences.

The Bottom Line

2023 became a year with a historically high number of bank failures. It is therefore more important than ever to perform a good amount of due diligence when choosing your bank. We believe the three options described above are three solid options that offer high interest accounts. Banking has been one of those industries that has adopted the online model slowly as there are still customers that prefer having the convenience of branches. However, new banking players, such as the ones mentioned in this article; are taking a page from the book of companies like Amazon by being “online-first” financial institutions. By being online-first, they can lower the overhead cost of running local branches, and pass those savings on to consumers in the form of higher interest rates and lower fees.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Axos Bank Review [2024]](/assets/images/0659625aca4057107f87958725d39792.png)