In the modern era, everyone uses credit cards to pay for things. So, it makes sense to teach your children the fundamentals of credit and how it works. This way, they're more financially prepared for the future and can make smarter decisions about how and where they spend their money.

Fortunately, it's never been easier to find prepaid credit cards for kids and teens, many of which come with special perks and features. We've compiled a list of the top six options so you can make a wise investment in your child's future.

Top 6 Prepaid Credit Cards for Kids and Teens

What We'll Cover

- Top 6 Prepaid Credit Cards for Kids and Teens

- Greenlight Prepaid Card

- BusyKid Prepaid Card

- goHenry Prepaid Card

- Current Visa Debit Card

- FamZoo Prepaid Card

- TD Essential Banking

- How to Pick a Prepaid Credit Card for Teenagers

- Comparison Table of Prepaid Credit Cards for Kids

- FAQs About Prepaid Credit Cards for Teenagers

- Which Banks Offer Credit Cards for Kids?

- Is It a Good Idea to Give My Child a Prepaid Credit Card?

- Is There a Credit Card That My Teen Can Use as an Adult, Too?

- Stats About Prepaid Credit Cards for Teenagers

Greenlight Prepaid Card

According to Greenlight's website, over six million parents and children have used this card, so it has a pretty impressive pedigree, no matter what. Once you look at all the benefits of using Greenlight, it's easy to see why it's one of the top prepaid credit card options.

First and foremost, you can load the card with as much cash as you like. Since it's a debit card, it will only work if there are sufficient funds in the account. Best of all, transfers are immediate, and you can tie them to chores or other actions. This way, your child can earn money, just as they would with a job.

Beyond that, Greenlight also helps your teen with financial literacy and investing help. They can learn more about different investment opportunities to grow wealth into the future. Greenlight has a "Level Up" game that teaches them the basics of finances in a fun and engaging way.

Finally, you can monitor the account and see what your kids are doing, as well as halt transactions if necessary. Or alternatively, if your child needs money immediately, you can transfer funds without waiting a few days for the balance to clear.

Price: $5.99 to $14.99 per month (no fees)

- Teaches children about finances and investing

- Tie allowance to chores or other activities

- Get notifications about spending habits and account balances

- Immediate transfers with no waiting

- Advanced security to protect the card

- Costs more than other cards

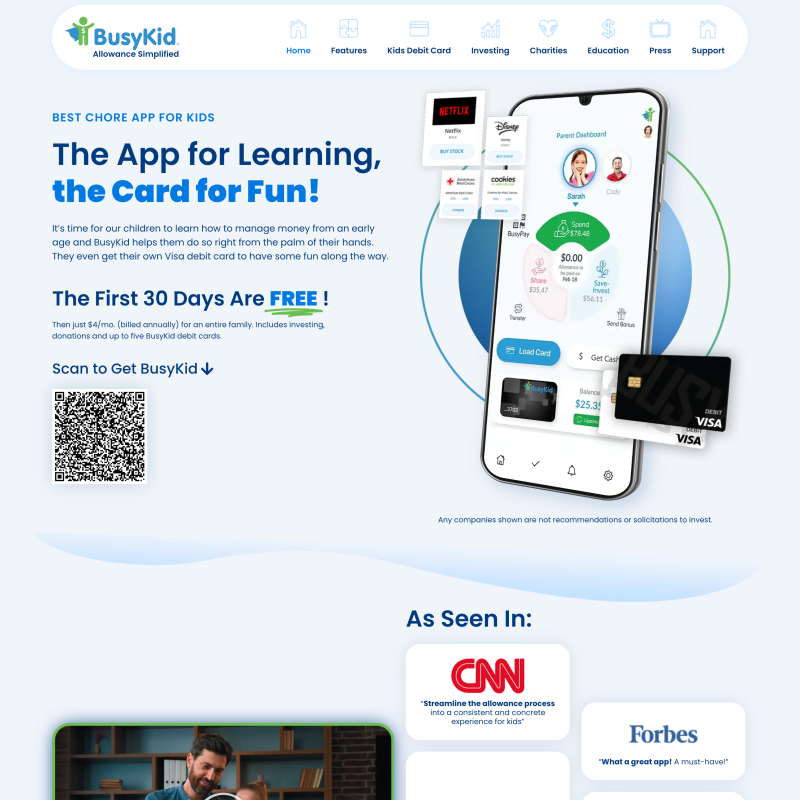

BusyKid Prepaid Card

Depending on the age of your child, you can either give them a BusyKid Jr card (for ages 3 to 5) or a regular BusyKid card for kids ages 6 to 16. Both cards work the same way, although the standard card has a few extra perks.

As with Greenlight, you can put in chores and assign dollar amounts to each one. By default, BusyKid will transfer funds every Friday based on the chores completed, and you get to verify whether your child has earned the money or not. However, if your kid needs the card reloaded before Friday, you can make an immediate transfer instead.

Along with investing and saving tools, BusyKid also enables your child to donate to charity. This perk incentivizes your little one to give back to the community and helps them learn about philanthropy in the process. Finally, you can offer bonuses if your kid does something special, such as straight A's on their report card.

Cost: $48 annually

- Intuitive parental controls

- Offers investing, saving, and charitable donations

- Set allowances based on chores or achievement bonuses

- Immediate transfers

- Advanced security and monitoring controls

- Automated matching for savings (if you want)

- Not available for children over 16

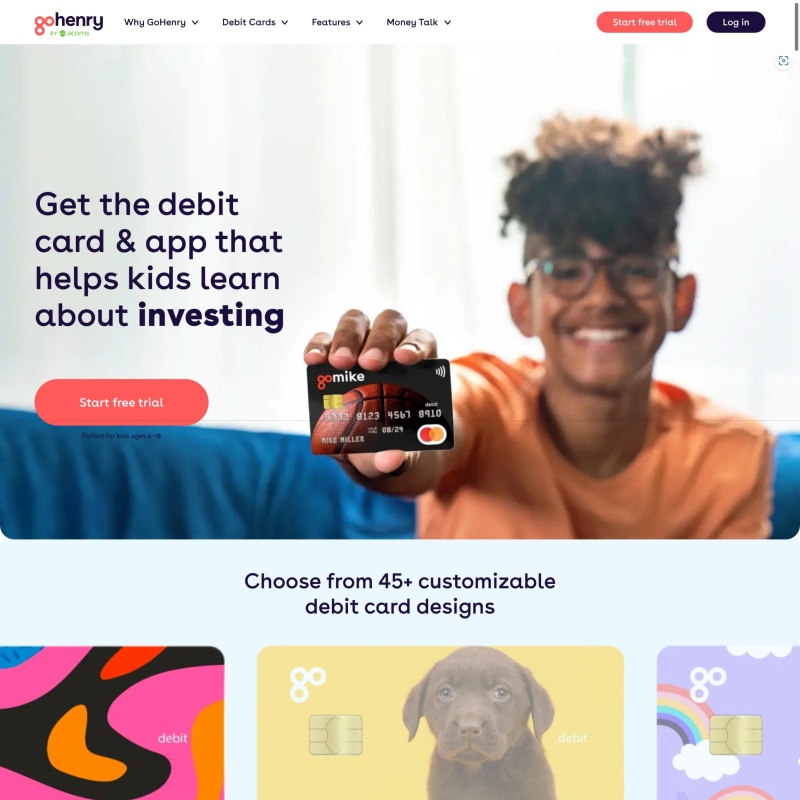

goHenry Prepaid Card

According to the website, goHenry has over two million subscribers, and to use this card, you must download the app first. This card is also only designed for children ages 6-18, so if you have younger kids, you'll either have to wait or sign up for a different debit card account.

This option is great if you just want a simple system to help your kids learn about earning, spending, and saving money. GoHenry doesn't have as many features as other cards like Greenlight, such as investing or charitable donations. However, you can still keep track of how your child uses the card, and you can make instant transfers when necessary (or set up automated payments).

Another point to consider with goHenry is that you have to pay $4.99 per month per child. So, if you have multiple kids, your monthly fees can add up. Alternatively, if you have up to four kids, you can pay for the family plan of $9.98 per month to save some money.

Price: $4.99/mo per kid, or $9.98/mo for up to four children

- Easy-to-use app

- Instant money transfers

- Money missions teach your children about finances

- Spending transparency

- Help your kids set savings goals

- Tie allowances to chores

- No investing or donation option

- Costs more when you have multiple children

- Not available for very young kids

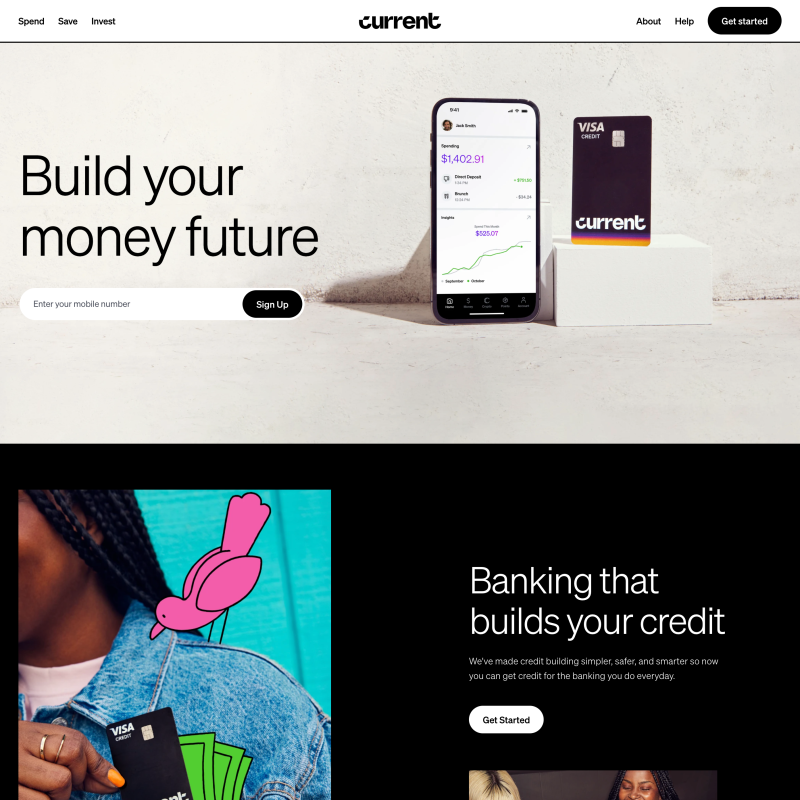

Current Visa Debit Card

So far, we've only been looking at debit cards that are tied to your bank account. Current works a bit differently because it's a credit card that also offers a debit spending option. While official "credit cards" are only available to adults, you can open an account for yourself and then add your teen as an authorized user. This way, your child can access all the perks without any of the risk.

Because your Current account is tied to a credit card, it does affect your child's credit score. However, if you help them make smart financial decisions and avoid getting into debt, they can set themselves up for a higher score later in life. So, this option works best if you want your child to build credit for the long term, not just learn the basics of using a credit card.

Price: No annual or monthly fees

- Set spending limits for your teen

- Helps your child build credit

- Access to a personal checking account

- Free direct deposit if your child is working

- No financial literacy tools or investment insights

- There is a risk of your teen accruing debt and damaging their credit score

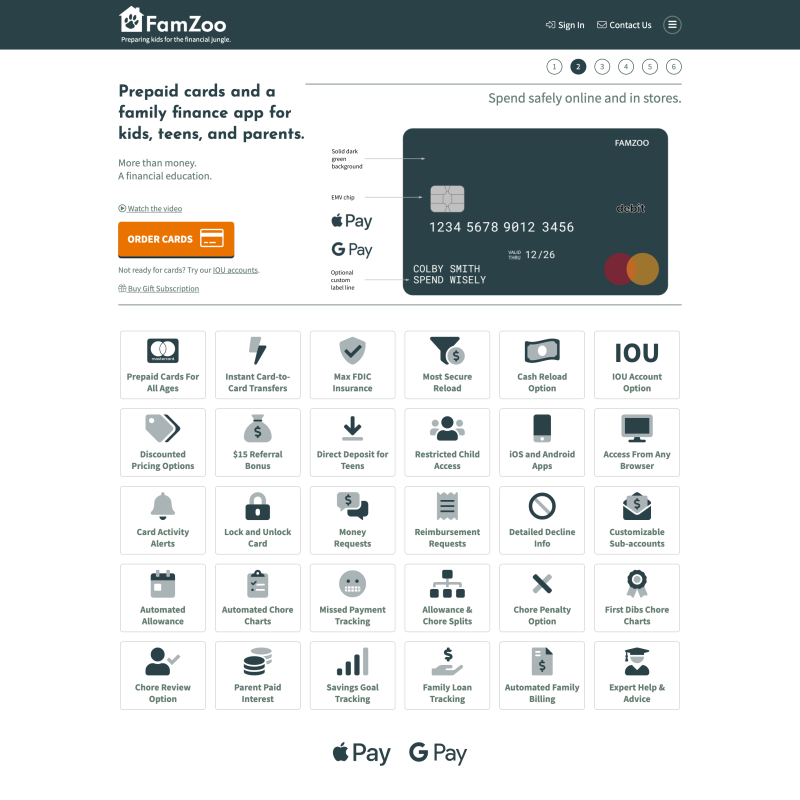

FamZoo Prepaid Card

FamZoo's goal is to teach financial literacy to everyone, including parents and children. It does this by offering a family-friendly prepaid credit card that doesn't have to be tied to a bank account. Instead, you can load the card with cash at a retailer or use direct deposit to fund the account.

Education is at the forefront of FamZoo's design, so you can teach your children about how to save money, how to invest, and how to plan for the future. There is no minimum or maximum age requirement, so your child can use the same card throughout their adolescence until they're ready to apply for a personal credit card.

This card also has extended financial tools like sub-accounts, reimbursement requests, IOU options, and more. This way, your child can become financially literate sooner rather than later.

Price: $5.99/mo (or there are prepayment options to lower the price to $2.50/mo)

- Tons of educational tools and features

- Available for children of any age

- Helps with saving and investing

- No bank account needed

- Subscription price is per family, not per child

- No investing options

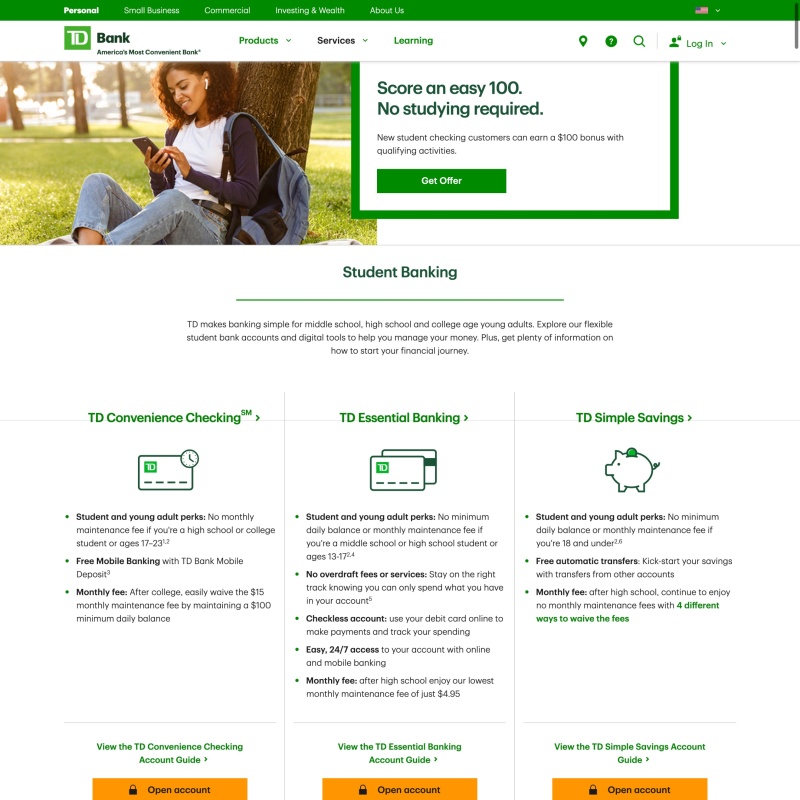

TD Essential Banking

While prepaid credit cards can help your child or teenager learn about how to spend and save money, it's also important to help them understand savings and checking accounts. So, you can open a TD Essential Banking account for your teenager to get them on the right financial path.

This account is only available for teens ages 13 to 17. Once your child turns 18, they become owners of the account, and the monthly fee of $4.95 starts. Because this is a checking account, your teenager can get a debit card attached to it. As long as you're the account holder, you can monitor their activity and set parental controls on the card.

One of the main advantages of this option is that your child can keep the account forever after they turn 18. So, you can teach them financial literacy and then set them up for future success.

Price: None until your teen turns 18, then $4.95/mo

- Create a checking account for child to use forever

- Get checks and a debit card for the account

- No fees until your child turns 18

- Moderate parental controls to help your child's spending habits

- No educational tools or investment options

How to Pick a Prepaid Credit Card for Teenagers

Although we've shown you the top six options for children, the fact is that numerous prepaid credit card options can work for your teenager. Plus, once your teen turns 18, you can help them pick the best card to build their credit and earn rewards and perks.

So, here are a couple of factors to consider when comparing different cards and whether they're worth getting for your child.

Adequate Parental Controls

For most kids, the concept of money is somewhat abstract. Your child may understand that money is necessary to pay for things, but they might not recognize the value of a dollar.

So, you have to be able to keep track and step in when appropriate. Make sure to choose a card that allows you to monitor your child's spending and saving habits. This way, you can discuss those habits with them and help them make smarter choices if necessary.

Another useful tool is the ability to freeze the account at any time. This way, if your child loses the card or gives it to a friend, you can prevent any erroneous charges and save your money.

Integrated Tools for Money Management

While a basic credit card system is useful, you want a card that can actively help your child understand their finances. So, a card that offers educational content about investing, saving, and other financial situations can help them make better choices now and in the future.

The other benefit of having integrated money management tools is that you don't have to monitor your child all the time. They can learn at their own pace, and you can step in and provide guidance when needed. Also, having multiple options (i.e., saving or investing) can help your child forge their own path with their finances. In some cases, that may even be showing them how to cash out a prepaid card if they need physical money for any reason.

Comparison Table of Prepaid Credit Cards for Kids

| Credit Card | Greenlight | BusyKid | goHenry | Current Visa Debit Card | FamZoo | TD Essential Banking |

| Min-Max Age | N/A | 3-16 | 6-18 | 13+ | N/A | 13+ |

| Auth User Fee | N/A | N/A | N/A | N/A | N/A | N/A |

| Monthly/Annual Fee | $5.99 to $14.99/mo | $48/year | $4.99/child/mo | N/A | $5.99/mo or $39.99/yr | None until child turns 18 |

| Secured or Unsecured Credit? | Secured | Secured | Secured | Unsecured | Secured | Secured |

| Builds Credit Score? | No | No | No | Yes | No | No |

| Bank | Mastercard | Visa | Mastercard | Visa | Mastercard | TD |

| Works w/Amazon? | Yes | Yes | Yes | Yes | Yes | Yes with TD Debit Card |

FAQs About Prepaid Credit Cards for Teenagers

Which Banks Offer Credit Cards for Kids?

Visa and Mastercard are the two primary options for prepaid debit and credit cards. You can link these cards to your personal bank account, so they work with virtually any bank in the US.

Is It a Good Idea to Give My Child a Prepaid Credit Card?

Yes, if you want to help your child learn about money and how to use a credit card. By monitoring their activity and providing insight into financial matters, your teen can be much savvier when they become an adult.

Is There a Credit Card That My Teen Can Use as an Adult, Too?

Yes, Greenlight, Visa Current, and FamZoo allow your child to use the card at any age. However, once your child reaches 18, it may be good for them to apply for a personal credit card so they can manage their own finances. Overall, Current is the only "credit card" that offers an unsecured line of credit and helps build your teen's credit score.

Stats About Prepaid Credit Cards for Teenagers

How Common are Credit Cards for Teens?

According to data, about eight percent of American parents have given their children prepaid credit cards.

Top Reasons Why Parents Give Teens a Credit Card

The top five reasons why parents get a prepaid credit card for their child include:

- Teach Financial Responsibility

- Build Healthy Financial Habits

- Building a Credit Score

- Emergency Cash

- Track Child's Spending Habits

Average Age for Children to Receive Prepaid Credit Cards

According to a recent poll, 13 is the most common age for parents to give their kids a prepaid credit card. A majority believe the older, the better, as 33 percent of respondents said the child should be 16 or 17 before getting a credit card. Only four percent said a child under five should have one.

No matter the reason for getting your child a prepaid credit card, you now have the tools and information to make the right decision for your family.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.